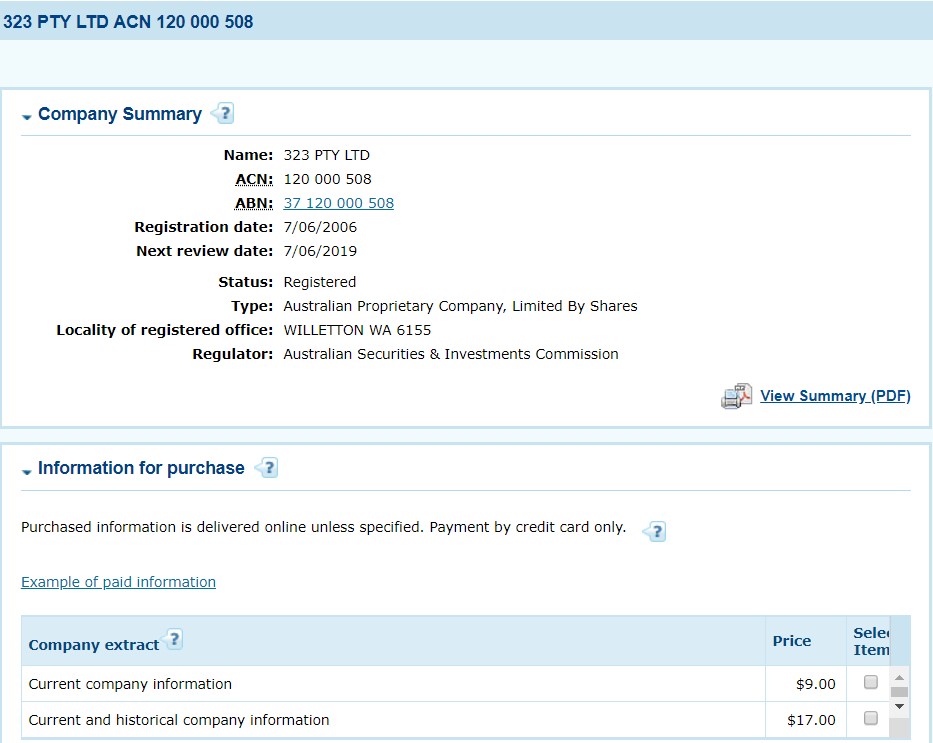

IFS Markets is not a new brokerage in the Forex world. In fact, it is older than some of the most popular brokerages out there right now. So it may raise the question, why have I never heard of it? Well, there are a couple of reasons. According to our IFS Markets review, we found out that the broker is exclusive for Australian clients only. They feature an ASIC license with the number 323 193 and have been operating in the country for nearly 13 years now. 13 years is like a couple of lifetimes for Forex broker standards, which needs to be commended broker.

|

IFS Markets Review

|

IFS Markets Forex broker is able to include some very attractive features, but deep down, these features turn out more as liabilities than assets. The minimum deposit with the broker is $0, it has 2 types of accounts: Standard & Pro, the maximum leverage is 1:400, is licensed by the ASIC, Has various payment methods like Skrill and Neteller, fields MT4 and WebTrader.

The Transparency

Overall, the transparency in terms of most of the information is quite nice with the broker. Finding relevant information was just 1 click away in most cases. However, we did indeed find some questionable decisions on the broker’s part which sometimes led to the IFS Markets scam thought popping up. Thanks to their 13 years of experience in the industry, we were quick to dismiss such thoughts, because it is simply impossible.

Let us discuss all of the features in detail and see exactly what we mean by “questionable decisions”.

Spreads & Commissions

Spreads are always a relevant topic for Forex brokers as they are a way to see how the company makes money. If the spread is tight, it means the company has enough customers to keep it that way. If it is too high, it means they are quite small. However, if a company features commissions it is always recommended to avoid it as it tends to rack up more in costs. IFS Markets Forex broker features both of these options, but as already mentioned, with questionable methods. They mostly revolve around the Account Types.

There is no clear indication about what the spread is like, is it tight? Is it floating or fixed? What is the commission percentage, so all customers have to do is guess.

Account Types

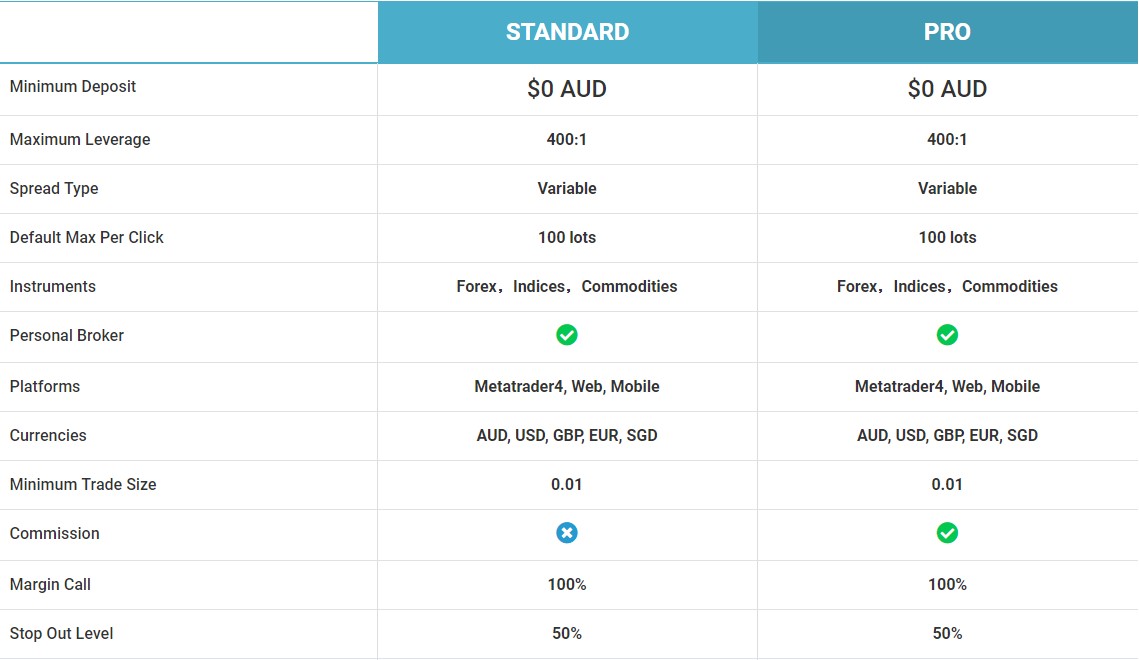

As already mentioned, the questionable decisions about Spreads and Commissions is rampant with IFS Markets Account types. There are 2 types right now, the Standard Account and the Pro Account. In fact, the questionable decision could be the fact that these two accounts are practically identical. The only difference is that the Standard Account is spread-based, while the Pro Account is commission-based.

If that isn’t a questionable decision, then we don’t know what is. In fact, this is where we had the IFS Markets scam thoughts again, because the only logical explanation is that, the spread is so bad on the Standard Account that traders prefer to switch to a commission-based one instead, even if it means paying more in the long-run.

IFS Markets Withdrawal

The withdrawals with the broker are actually quite nice at a first glance. The variety of payment methods is always welcomed, but there is one HUGE detriment to the whole thing. The options are as follows: Credit/Debit Card, WIRE Transfer, Skrill, Neteller and etc. Everything except for Bank Transfers has a 2% fee on it. Both on withdrawals and deposits. Sure the 2% may not seem too much, but imagine if you are withdrawing $20,000, which is mostly the case for experienced traders. You’d have to pay $400, if you want it done via credit card. Otherwise, you’d have to wait for at least a week. This completely devalues the IFS Markets withdrawal system in our opinion as even the largest brokers offer these services without a cent as a fee.

The minimum deposit system was a sign of relief. It is currently sitting at $0, so you can open an account without depositing a single cent.

Trading Platforms

IFS Markets currently has 2 major trading platforms. These are MT4 and WebTrader. Although the variety isn’t the best here, it is still nice to see a veteran such as MT4 be featured. Furthermore, the platform offers ZuluTrade, White Label and MAM. The IFS Markets MT4 option is probably the best one to go with in all honesty, as it is the safest and more optimized for outside tools.

Leverage & Regulation

As already mentioned, IFS Markets is regulated by the ASIC. In fact they have been regulated for nearly 13 years now. The license was given on June 7th of 2006, and will be reviewed on the same date this year. It is expected that the license will be renewed.

IFS Markets FX brokerage is able to offer a leverage of 1:400 thanks to the Australian Regulation, as ESMA laws haven’t reached the continent yet. It may seem quite high for a beginner, but thankfully it is adjustable. The maximum leverage is of 1:400 is only for major currency pairs however, which is nothing new.

IFS Markets Review mash-up

So here we are at the end of our IFS Markets review. What is the final verdict? It is quite simple and can fit in a single sentence. “Reliable, but expensive”. Yes the brokerage is reliable in terms of legality, they won’t scam you or defraud you of your money, but the features you get for the price you pay way below average. There are 1 year-old brokerages out there that, although feature higher minimum deposits, have way better offers on both withdrawals and spreads. So, can IFS Markets be trusted? Yes, it definitely can be trusted, but it doesn’t mean you should start trading with them. There are way better options.

[RICH_REVIEWS_SNIPPET category=”page”] [RICH_REVIEWS_SHOW category=”page”] [RICH_REVIEWS_FORM]