Finq.com has a pleasant layout. It is one of those websites which many Finq reviews will say is easy to understand and navigate. But as we all know, the website layout is just but a small factor which a trader must look into when in search of a good Forex broker. In our Finq review, we are going to look into features such as regulation and licensing details of the broker, customer support, types of accounts and leverage.

|

Finq.com Review

|

Finq Forex broker review

Finq.com Forex broker was established with the aim to serve the Asian market. The firm’s platform which is relatively new is available in Urdu, Thai, Vietnamese, Chinese, Malaysian, Arabic, Tagalog and Indonesian. However, the firm has made an effort to also include Spanish, English, German and Albanian. According to the official website of the broker, people who reside in the European Union, Canada, USA, Belgium and several other jurisdictions cannot access the broker’s services. Clearly, Finq concentrates on serving a small section of the FX market.

The licensing details of the Finq broker

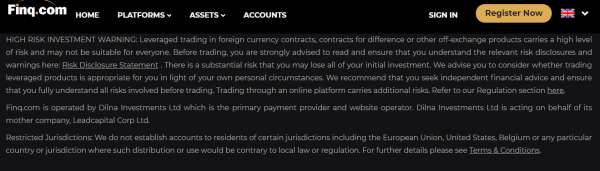

Finq Forex broker is owned by Leadcapital Corp Ltd (LLC) which has been around since 2014. According to the Finq website, Leadcapital Corp is a licensed financial service provider in Seychelles and is licensed by the Financial Services Authority of Seychelles. The company’s license number is DS007. Further perusal of the official website will show you Leadcapital’s address to be Office Suite 3, Global Village, Jivan’s Complex, Mont Fleuri, Mahe.

In this Finq.com review, it will become apparent to you that Leadcapital Corp which is related to Leadcapital co. is designed to serve the Asian market where financial rules are quite relaxed or at times very weak. Leadcapital Co. is licensed by Cyprus Securities Exchanges Commission (CySEC). It conducts business in accordance with the European financial rules which are quite strict. In light of this, many Finq opinions out there are that Finq is not the best-regulated FX broker in the market. This is because Seychelles happens to be a tax haven and there are many shell companies incorporated here. In addition to that, Seychelles financial laws do not require you to be in the country physically in order to register a Forex brokerage firm. The law also somehow overlooks the importance of a broker keeping separate segregated accounts for its clients.

The Finq Forex broker website is operated by Dilna Investments Limited. Dilna is the main service provider and website operator. It is worth noting however that Dilna acts on behalf of Leadcapital Corp.

How is trading at Finq.com?

Our Finq scam review reveals how the broker offers more than 2,100 different assets among them CFDs, metals, stocks, and currencies. It is this ability to provide a wide range of assets that many traders are attracted to a broker. The broker has even gone ahead and adopted more than 10 cryptocurrencies on its trading platform.

The trading platform of the broker affords traders with MT4 which is the world’s best and most popular trading tool. The tool comes with very efficient market analysis features and it is easy to use. Also available is a web-based trading platform which can be used with almost any PC. On top of this, you can download some mobile apps which are compatible with iOS and Android mobile devices.

Leverage and spreads Finq.com reveiw

The leverage at Finq Forex broker site is relatively high. Several years back, it was not uncommon to find a broker offering leverage of more than 1,000. Several jurisdictions among them Japan and the European Union have introduced laws which require brokers to offer low leverage to their customers. In Japan, for example, the leverage for popular currency pairs is 1:25 while in the EU it is 1:30. This is why in this Finq.com review we are saying the leverage of 1:300 offered by Finq in quite high. As for the spreads, the firm allows 2 pips for a standard account. A keener look will show you that the broker acts as a market maker and therefore you should be careful when it comes to spreads.

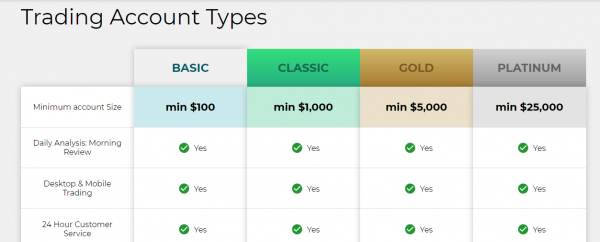

Types of accounts to enjoy at Finq

At Finq, you will find four different types of accounts namely; Basic, Classic, Gold and platinum. The Basic Account requires that you make an initial minimum deposit of $100. The features that come with this account include desktop and mobile trading platforms, daily analysis and 24-hour support. The Classic Account asks for a minimum deposit of $1,000 but it comes with a dedicated account manager and webinars as extras. The Gold Account requires a deposit of $5,000 while the Platinum Account asks for $25,000. The Platinum Account comes with premium daily analysis. The payment methods found here include Neteller, FasaPay, Skrill, wire transfer, and credit/debit cards.

Is Finq.com legit?

In order to answer this question properly, you will need to look at the key features of the broker keenly. As we have seen in our Finq.com scam review, you can see that the broker is licensed by FSA Seychelles which is not a globally renowned financial regulator. Moreover, Seychelles attracts shell corporations which means that there is a big risk that you might be placing your hard earned money into the hands of a ‘ghost’ corporation if you open an account with Finq. The other factor to consider is the initial deposit that the broker asks its clients to deposit. The 100 US dollars is quite high given that there are established and more reliable brokers out there that ask for much less.

[RICH_REVIEWS_SNIPPET category=”page”] [RICH_REVIEWS_SHOW category=”page”] [RICH_REVIEWS_FORM]