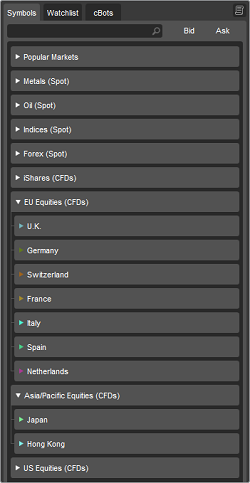

In recent years cTrader has securely placed itself as an industry pioneering trading platform. Evolving from FX only into what is now a powerful multi asset class CFD trading platform which has been loaded with hundreds of new features over the past 5 years. Now, some of the dozen or so industry dominating brokers offering cTrader are doing so with thousands of symbols; ranging from equities, indices, commodities and of course, still FX.

cTrader is certainly a favourite for our editorial team and we wanted to asses how the platform has developed over recent years and how it now competes against similar products. Since many reviews on this platform are outdated, as are the sites they are posted on, here you can find the freshest cTrader review.

cTrader is certainly a favourite for our editorial team and we wanted to asses how the platform has developed over recent years and how it now competes against similar products. Since many reviews on this platform are outdated, as are the sites they are posted on, here you can find the freshest cTrader review.

In case you’re interested in the company bio; Spotware Systems Ltd. are the developer, owner and vendor of the platform suite which they supply to any Non Dealing Desk, STP broker that wants to offer it to their traders and connect to their prefered bank or non bank liquidity provider. The company is headquartered in Limassol, Cyprus and has been operating since 2010, and launched the first version of cTrader just 9 months later.

Since the purpose of this review is to give you an overview of the key features of this platform, I will start by exaggerating that the level of intuition needed to master the primary functions of the platform is next to nothing and just a couple of hours are needed to discover the more advanced benefits; for example their Fair Stop-Out, Advanced Take Profit and Deal Map, and now I just spoilt the surprise!

At first glance, the appearance of the platform looks appealing and clean compared to other well known platforms you may be familiar with. Being active in forums I know for a fact that traders believe that attractive must mean unserious and playful; then ugly and complicated must mean sophisticated. This is absolutely wrong. cTrader is well groomed and ergonomics are an essential part of being able to react quickly to changing market conditions, going through menus only slows you down.

Now, here is what I like, and believe you too will like about cTrader:

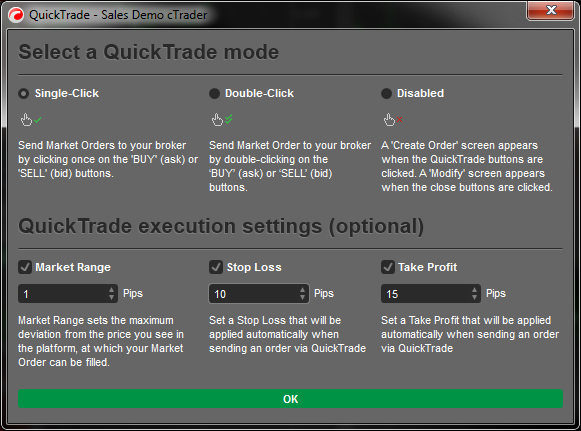

Quick Trade

cTrader has well located QuickTrade buttons on the chart as well as in each expanded symbol in the Market Watch where you can create not only market orders but also Limit and Stop orders from the Price Depth of Market, making cTrader’s three Depth of Market types more than just indicators. cTrader allows you to predetermine the properties of your orders when you use QuickTrade, my favourite is that you can apply a market range, and of course you can ensure that a default Stop Loss and Take Profit will be applied and you can later apply advanced properties.

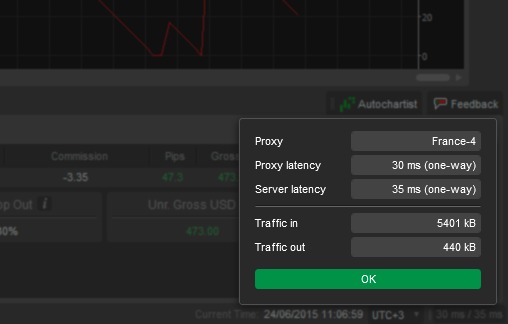

Execution

I opened a live account with three brokers altogether, each I deposited just 200 USD to test a selection of them rather than a single one and see what results I came back with. While there are some very minor differences in the price, that is to be expected, since I would assume those brokers don’t have the same liquidity providers. What I did notice is all of my trades were executed within a similar time period, all between 70 and 80 ms. Once thing I love is the Market Snapshot which is saved inside every deal ticket. It shows the order book at the time your deal was executed, and helps you to understand the VWAP price your order was filled at.

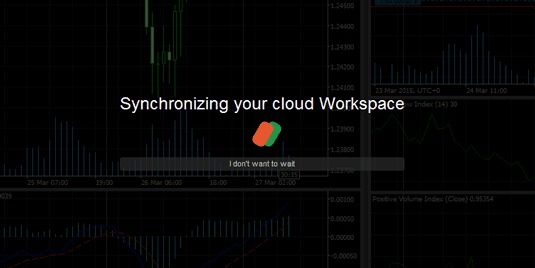

cTrader ID

cTrader ID lets you access the multiple cloud services cTrader offers and creating one is the first thing you should do with the platform. You can receive email notifications about a variety of events including your Price Alerts, Custom Margin Call Alerts, whenever a deposit or withdrawal occurs and whenever a pending order, stop loss or take profit is triggered. Having a cTrader ID also lets you save your chart workspaces and your favourite chart templates from other computers or brokers platforms, which is particularly useful as you don’t need to find your favourite set of indicators every time. Having a cTrader ID also lets you link multiple accounts to your cTrader ID to switch with ease and finally gives you access to cMirror, which is cTrader’s accompanying mirror trading platform.

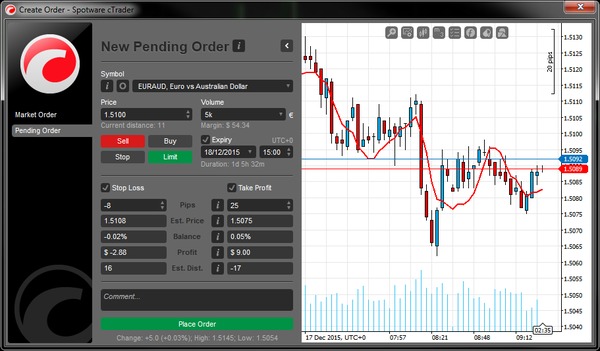

Order Screens

cTrader’s order screens are highly informative and give a very good insight into the accounts resources which will be used for the order, the end result of the protection properties as they are manually adjusted and a chart of that symbol.

As you can see, the order screen calculates margin usage for the desired volume, distance to desired price and duration until entered expiry of order. The screen also gives a forecast of the end result when either the Take Profit or Stop Loss has been triggered. The screen shows you a percentage and cash value of balance you will lose or gain and the current distance to the trigger. All in all, a very detailed screen indeed.

Charts

Anything object you put on top of cTrader’s charts can be controlled with so much ease, a small thing which seems to be lacking from most other platforms and makes your experience far more comfortable! Charts can be moved freely can objects and even orders. You can drag and place Take Profit, Stop Loss, Limit and Stop Orders and as you do so price markets reconfigure and only become visible on mouseover which stops the chart from becoming cluttered. The Deal Map behaves in the same manner, a tag displaying information on the deal only becomes visible once clicked. The Deal Map can be easily enabled and disabled as a viewing option, just like bid lines, ask lines, the grid, period separators etc. basically, awesome charts!

Market Watch

I already brought up the Market Watch when explaining the QuickTrade features but I would like to elaborate on how functional this section of the platform is, particularly so since you can detach each of your favourite symbols from the platform and place on another screen and view the full depth of market while all buttons remain functional, as do all of the charts you detach and can fully manipulate just as if they were still inside the platform.

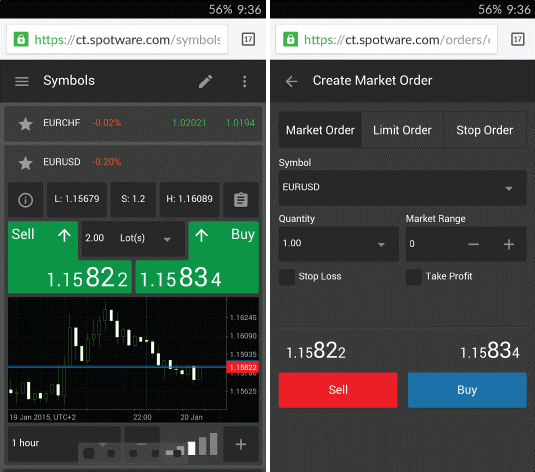

Mobile Apps

You can get the cTrader App on your iOS or Android device to access your account and trade from anywhere. One of the most impressive aspects of these Apps is they are packed full of indicators, charting tools and customization options. This gives you literally the same trading experience, but in the palm of your hand. You can get a demo of these apps from Google Play or iTunes Store or just launch cTrader Web in your phone browser and create an account in the platform or log into your existing Spotware Demo account.

Conclusion

All in all, cTrader is a fantastic platform which is truly sophisticated and refreshing. The only downside is the number of brokers offering the platform is quite limited and sits in the region of about 20 huge names. The only logical reason I can think this could be due to is the platform is relatively new but we are certain of the fact that in the next 5 years, we will be looking at hundreds!