When it comes the time to pick the most ideal Forex broker, many traders find themselves swamped because there are hundreds if not thousands of FX brokers to choose from. You will need to rigorously evaluate and compare several FX brokers’ features in order to be able to pick the right one. Capital.com is one of the many FX brokers you can opt for. In this Capital.com review, we are going to take a peek at some of the key features of the firm. This will help us know whether the broker is legit or not.

|

Capital.com ReviewSign up with XM instead |

Capital.com FX basic information

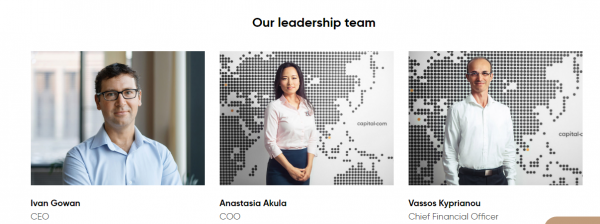

Capital.com Forex broker was established in 2016. The company is owned by Capital com Investments Limited which is a Financial Investment Firm based in Cyprus. Its registered in Cyprus and its registration number is HE 354252. Capital Com SAV holds a Cyprus Securities Exchange Commission (CySEC) trading license; number 319/17.

In this Capital.com scam review, it is important to note that many Forex brokers seek a Cyprus trading license because the government here is very friendly towards them. And also because CySEC is one of the most prestigious financial regulatory bodies in the world. The tough MiFID regulations which apply to all EuroZone countries also apply to Capital.com. One of the regulations is that in case a firm goes down, a broker must be in a position to refund up to 20,000 Euros. Capital.com also enforces the new ESMA regulations which state that leverage for currency pairs cannot go beyond 1:30 and that of cryptos to stay below 1:2. This means that with a capital of $100 you can control a position of $3,000 if you are trading currency pairs.

How is trading at Capital.com?

Like is the case with a majority of FX brokers today, Capital.com seeks to lure new clients using several incentives and features. The trading platform available include Mobile Apps which are compatible with both iOS and Android devices. In addition to this, the firm also has a web-based platform and an in-house platform called Investmate. In our Capital.com review, we found the popular MT4 platform is not available even though Investimate does a commendable job at replacing it.

The broker offers its clients more than 700 trading instruments which include CFDs, stocks, currency pairs and the now very popular cryptocurrency. The broker seems to have invested in the platform as there are several intuitive features here which help a trader make better and informed trading decisions. According to the website, traders can enjoy tight spreads of 0.6. The website further states that no commission charges are applied even though this is hard to verify given that the broker doesn’t offer a demo account account where one can test the platform.

The accounts at Capital.com Forex broker

Capital.com Forex broker offers four different types of accounts namely; Retail, Plus, Premier, and Professional. The minimum initial deposit which the broker requires from a Retail Account trader is $100. The features you get to enjoy when you sign up for the Retail Account are Advanced Charts, Range of markets and Negative balance protection. The Plus account and Premier account require a deposit of $3,000 and $10,000 respectively.

When you read many Capital.com reviews and visit the official website, you will find that the Professional Account requires a minimum initial deposit of $100. The leverage enjoyed by traders in this bracket is 1:200. This is an exception made by the new ESMA regulations which were introduced in August 2018. Among the features to enjoy when you open this account include Exclusive webinars and cash rebates.

Is Capital.com legit?

This is a question that many new traders grapple with. The answer to this question can be answered easily when you look at some of the features of this online broker. The licensing details which happen to be the most important when one is searching for an online broker are readily available on the firm’s website. The broker is duly licensed by one of the best regulatory bodies in Europe; CySEC. In addition to this, the broker has put a disclaimer at the bottom of the website which states that 77% of retail traders lose money when they trade with this broker. This is one of the conditions every broker had to follow with the new ESMA regulations and is meant to warn the general public of the high risks involved trading FX. For a newbie, the $100 is a reasonable initial deposit even though there are other brokers that ask for lesser amounts. In many Capital.com opinions that you will come across, you will note that this is one of the few brokers that actually have a Professional Account which is compliant with the ESMA regulations.

After perusing the official website of Capital.com Forex broker, we can see signs that the broker is a market maker which makes it less attractive. The fact that the broker does not have MT4 as one of its trading tools makes it difficult for some traders to come on board. It is also important to note that the broker does not offer demo accounts and the charges relating to several trade options are not clear. Despite this, one can say that Capital.com is one of the safer bets for a trader shopping around for a legit FX broker.

[RICH_REVIEWS_SNIPPET category=”page”] [RICH_REVIEWS_SHOW category=”page”] [RICH_REVIEWS_FORM]