Automated Forex tend to be a more and more efficient tool nowadays, with computers beating man at century old Go games following learning for themselves how to make … intuitive moves. This was a breakthrough in computer world, and the implications for day to day activities are huge.

But let’s not digress, and focus on a very lucrative way to put technology at work in automated Forex trading. Namely, letting programs trade for you, open positions, close positions and decide based on specific algorithms. In short, a software will automatically make the trading for you, based on your predefined requirements.

Let’s see how this works and what are the pros and cons for using forex automated trading systems. Basically, the program follows some criteria, and once they are met, puts the call. No emotion, no oversight, simply math and programming. The trading rules followed by the automated system can be basic, focusing on averages, or the algorithm can be more sophisticated, based on taking into account more variables. Here lies the expertise of the person who programmed it or the complexity of software you decide to use. There are quite a few platforms and some of them are best automated forex trading systems available.

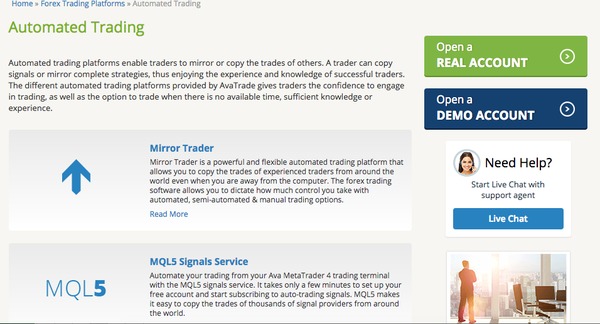

You have two choices – either rely on the programming of the platforms offering such solutions, or use a platform that allows you to put in the data of your interest and let it trade for you following specific criteria of your choice. Some platforms allow users to have own rules included in the application, or even to have some of these rules included in the platform with the support of the programmers, or just use the default rules set up by the platform programmers. After the rules are set, the platform starts working for you and it protects you from losing money and focus on the most profitable solutions and generate orders automatically.

Therefore, the advantages seem to be quite obvious. If you find a good platform, understand how it works and personalize it using well-researched criteria, you can win without too much effort or you can cut you losses to minimum.

We advise you to read Jack Schwager’s Guide to Winning with Automated Trading Systems.

Check EAs with 25 free EUR from Easy-Forex

Advantages of auto Forex trading systems

Probably the main advantage coming from using such a system is the lack of emotions. A computer will not take a decision based on a feeling, hunch or just because of a bad night sleep. It follows the rules, monitors the data, and once the criteria programmed are met, it puts the call. It will buy when the currency is at the specific level indicated, or when it dropped x%, as per the indications in its program. It will sell when the margin reached y%, as programmed and so on.

From this first pro comes another – the trading has a pattern, is more disciplined, without much frenzy due to rumors humans hear or negative/positive “sentiments” of the markets. Computers don’t take hazardous decisions just to make more money, or from the fear of losing.

Testing until making it perfect is another strong point of the automated forex systems. Most of the platforms or those designed by you directly offer the possibility to test your parameters before you actually start to trade with real money. This way, you can see how well your variables work, if there is a conflict, and find the most appropriate solution for your trading requirements. Once the trading system is in place, again, emotions disappear. The system will not stop its routine after a small loss or a gain below expectations, it will continue to trade following the rules and eventually make profit if the parameters are correct.

Check EAs with 25 free EUR from Easy-Forex

Disadvantages of the automated currency trading systems

But a computerized system doesn’t always bring advantages alone. There are, still, several low points from using auto forex systems. The so-called glitches of the system are not uncommon. As we said before, some conflicts may occur in between the general data input of the software and the data entered by the trader. Simple errors in programming, loss of connection, computer malfunction or outdated software may also be at the root of potential problems. That is why some monitoring is necessary. Basically, there is no such software that can be left alone for days and work for you on its own.

Productive, but not infallible

As a conclusion, automated currency trading system is a useful tool that will ease your work, will help you trade more, have higher productivity and a more consistent approach to FT trading, but, ultimately, it is up to you to reach best results with this kind of tool. It is not an infallible tool, first of all you have to know your markets and theory, and you will have to make a little research to determine what is the best solution and start using it.

Best automated Forex system

If you decided to give automated forex trading a try, you have two options – make a little research and find software that already holds the major parameters and use it with its default options, or make one for yourself (this is the hard way).

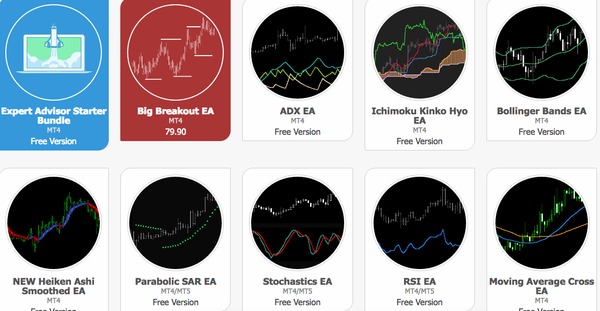

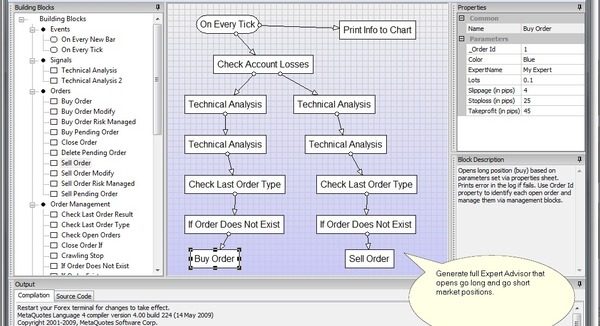

Therefore, let’s start with the harder way. The first thing you need for automated trading is an Expert Advisor (EA), which is, basically, a forex robot. This automated trading software places, changes and stops trade for you, using the MetaTrade 4 or MetaTrade 5 platform. Hence, you need a MetaTrader account and a Virtual Privat Server to keep you online at all times.

MetaTrade 4 guide

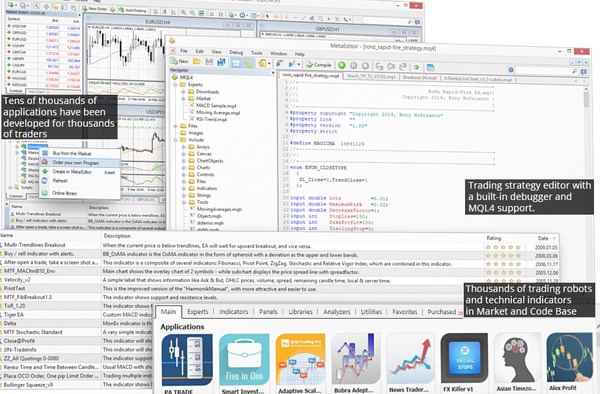

So, let’s focus on the MetaTrader 4. First of all, you will need to have a trading account with a broker of your choice (many of them offer the MT4 automated system as well). The platform allows you to develop, test and apply Expert Advisors and technical indicators. It features MQL4 IDE (Integrated Development Environment) that helps you work with EA.

MT4 EA allows traders to have their own trading strategies implemented in the program. This automated forex system features a MetaEditor that will help you with your programming. If you are not computer savvy, don’t worry, the program comes with its own guide and has an active community that will help you with any setbacks you may encounter. You may choose to work with the default settings, generated with the input of a wide variety of data from actual trading, or use your own preferences to personalize it as per your choice.

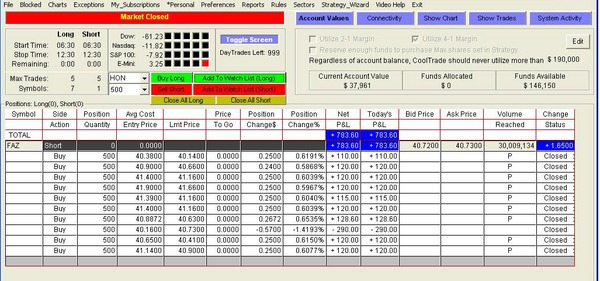

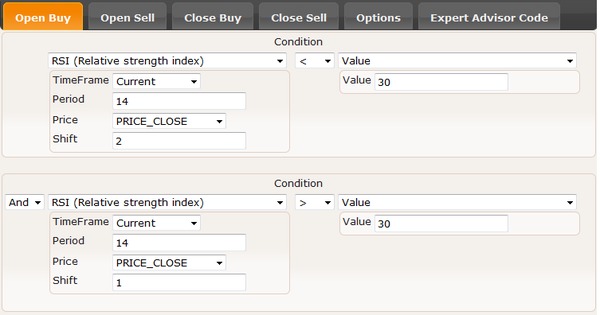

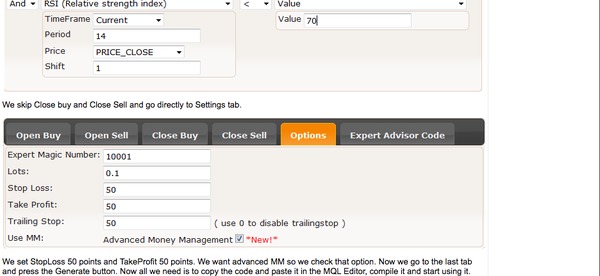

You can introduce parameters that will tell the program when to open a buy or a sell, when to close a buy or a sell and when to stop a loss or take profit.

Forex programs and scripts

Now, as explained, many brokers offer the Forex automated system MT4, some better than others. This is mostly related to the broker you choose. Let’s look at potential solutions. And we will work with some examples of platforms that got the best reviews from users. Just a heads up: the some programs are not free, but the costs go around 100 USD for many of them.

So, as explained, there are the predefined programs, that will pretty much work for you with default data. Some of them work with levels – above the line, below the line, take profit line. Once the levels are met, the program decides to sell, buy or cash in the profit. This is the basic solution.

Now, the paid Forex automated trading system solutions are more complex and developers offer you the possibility to buy and configure scripts as per your requirements, have several accounts (one master, and up to unlimited “slave” accounts). Such scripts allow users to adjust their lots, to personalize the copy orders for selected symbols, to put in analysis from EA. They also send trading alerts.

Therefore, you can adapt the coordinates as per your needs: trading time, levels, currencies, and let the platform work for you, without constant monitoring of the market.

Such programs, as explained, work better or worse depending on the algorithms included. Most of them are developed with the support of traders with more or less experience, hence the different results. Many of these EA’s are nothing but scams, a simple solution to take money away from the beginners, and far from their claim to be the best automated Forex trading system.

Check EAs with 25 free EUR from Easy-Forex

What to look for in an EA

The EA performance relies, just like in manual trading, on speed and information. Simply put, they need to have fast connections to the markets, get the information quickly and act upon it. The people behind the program are also key. They are responsible for updates and technological improvements. If such updates don’t happen, then you get stuck with an obsolete technology that can’t keep up with the market and that will help you empty your account at high speed.

And, maybe, one of the most important solutions of all: do not rely 100% on your EA. Use it rather as an assistant in your trading. Once you punch in your parameters, you actually design a trading strategy (I need to buy at this level, sell at this one, execute that position at that point etc). With your strategy outlined, EA is able to follow it and help you stay on course, without emotions, without hunches.

You do need to monitor the markets and adjust your parameters. Forex is not a static market, with single pattern behavior. It is cyclical, so strategies need to adapt to new realities. So needs you EA.

Let’s focus on how to create your own EA, for the forex auto trading system. Just search for an EA creator that is compatible with MT brokers. Most of the programs feature the possibility to test your strategy. Depending on results, you can then put several data: put a maximal quota that you can loose, manage the risk, put stops for selected criteria (breakeven for instance), introduce combined factors. And you should keep in mind that, of course, you have the possibility to automatically start or stop the EA once some parameters of your choice are met.

If you want to build your own trading robot, you first need to have a MT4 platform, that uses MQL4 (MetaQuotes Language 4) for code creation. MT4 is quite popular and, therefore, has access to lots of data. As we said, you need to think of a trading strategy and once that determined, design you EA.

Check EAs with 25 free EUR from Easy-Forex

Wizard creation

You need to go to the MetaQuotes Language Editor in your EA program to reach the Creation Wizard. Here you can add your parameters: name, type, value. You should know that you can delete any of the parameters you create. Once parameters put in the EA, the program takes you to the programming environment, where you will find your inputs. MQL4 also has some constants: OP_BUY, OP_SELL, OP_BUYSTOP, OP_SELLSTOP etc. If in doubt, the program helps you offering information on its functions: trading, conversion, file, date and time, variables etc. For those who want to use EA more like an assistant than a self sustain trading tool, it offers the possibility to have a manual confirmation for orders, or for called functions.

Human touch, essential

To conclude, the forex auto trading systems help you improve your results when used correctly. Like any other piece of technology, it relies on inputs, so the results are strictly connected to the commands you give, to the patterns you create and to the information you choose as relevant for your programming. We advise you to read best Forex books before you build your first robot.

And like any other piece of technology, it needs constant supervision and updating to give optimal results. If all data is correct and relevant, if you monitor the market and adapt your strategy to the cycles of the forex, you have good chances to reach expected results. However, if you think you download an EA, punch in some general data and hope for the best, then the best will never occur.